Valerii Liulchenko Christina Serebiakova

Broker & co-founder Broker & head of analytical department

https://millermagazine.com/blog/quality-of-ukrainian-wheat-2023-24-how-to-stay-on-the-key-markets-5567 - Atria Brokers for Miller Magazine

The current season in Ukraine is marked by an increased share of feed-quality wheat compared to the previous year, influenced by pre-harvest rainy weather. However, lower protein content and other factors have diminished the competitiveness of Ukrainian wheat, particularly in traditional markets like Turkey, creating additional challenges with Russia’s higher-quality crop. Preliminary estimates indicate that the share of feed wheat in Ukraine for this season is likely to be at least 65%.

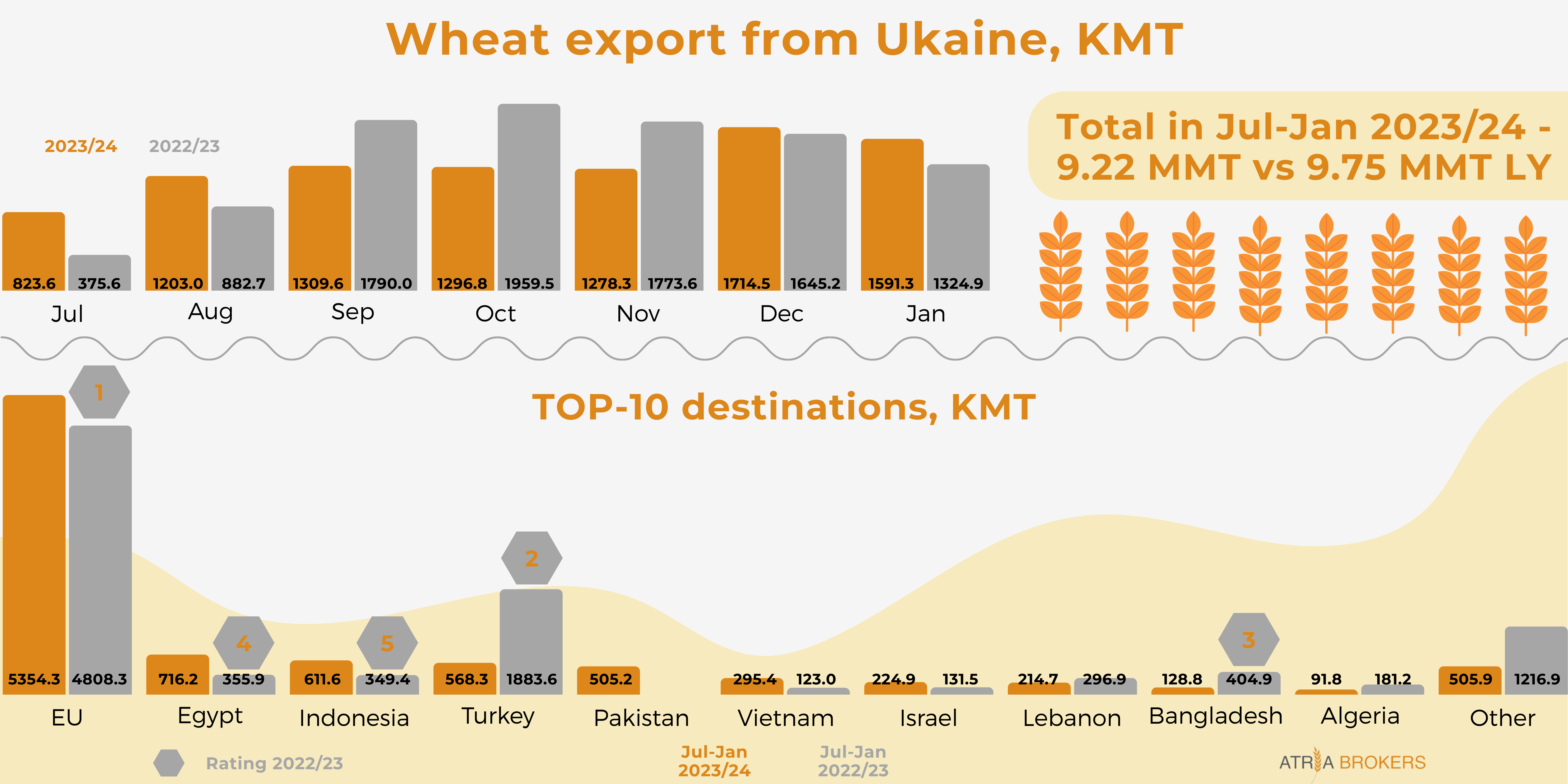

The distinctive feature of the current season is the higher share of feed-quality wheat in Ukraine compared to the previous marketing year due to rainy weather before harvesting. The lower protein content, test weight, etc., make Ukrainian origin significantly less competitive in its traditional markets, especially the Turkish market, and generate additional pressure from the large Russian crop, which has better quality. In the first half of 2023/24 MY (Jul-Dec), Ukraine exported 7.65 MMT of wheat, down from 8.42 MMT over the same period of 2022/23 MY. It is hard to assess the share of milling wheat, taking into account export figures up to date. As the Ukrainian corridor started in September, we lost such traditional wheat export months like July and August. And then in October started the corn program from deep sea ports. So only after the corn prices started dropping heavily since the start of January 2024, exporters began to switch to milling wheat export, which is mainly not above 11.5 protein content this season. This means that in the first place, at the beginning of the season export was mostly about corn and partly feed wheat, with milling wheat taking only a small share. So far, we guess that the share of feed wheat in Ukraine during this season is not less than 65%. Atria Brokers interviewed the representatives of key destinations in the industry to see the full picture.

UKRAINE LOSING TURKISH MARKET FOR RUSSIA: TEST WEIGHT MATTERS

Overall decrease in wheat supply combined with lower protein is resulting in smaller deliveries of Ukrainian wheat to its key buyer Turkey this season. In turn, Turkish millers are covering their demand with Russian origin that is difficult for Ukraine to compete with in terms of quality. Russian exporters offer not only 12.5% protein wheat with a test weight mainly a minimum 78 kg/hl, but even 10.5% wheat with 77 kg/hl test weight. While Ukrainian sellers offer 11.5% or 10.5% protein wheat with a test weight of 76 kg/hl. Ukrainian parameters are worse than they were last year when the offers of 12.5% protein wheat with 77 kg/hl TW were present.

As the result, shipment of Ukrainian wheat to Turkey decreased to only 370 KMT in Jul-Dec 2023/24 MT vs 1.7 MMT in Jul-Dec 2022/23 MY. For comparison, export of Russian wheat to the country exceeded 4 MMT in the first half of 2023/24 MY, up from 3.7 MMT year ago.

Begüm Dak,

Trade Director of Ulusoy Flour:

This year, we booked very few cargoes from Ukraine due to prices. Taking into account the wheat, which was delivered to our Çorlu milling factory, it had high moisture at 13% and above [from Author – maximum moisture by export contracts for wheat is 14%], low hectolitre (75 and below), low gluten, high starch. A separate question is the falling number. Contractually 11,5 protein wheat of Russian origin is mentioned as min. 250 falling number, but actual results on vessels are very often higher than 300, even sometimes close to 400. While Ukrainian 11.5 protein wheat very often has falling number at 330 and below [from Author – in 2023/24 MY most Ukrainian wheat specifications in contracts mention max. 230 falling number (Hagberg)]. As well, the germination rate is high and precipitation exposure is high in Ukrainian wheat. It can be used at a maximum rate of 30% in production blends, this rate can go up to 60% when looking at Russian wheat. Compared to Ukrainian wheat, Russian wheat is more preferred in terms of production efficiency.

However, the flour structure of Ukrainian wheat is better than that of Russian wheat in terms of ash and whiteness. Depending on the structure of the blend, even when 15-20% Ukrainian wheat is used, the effect on ash and whiteness is visible. A higher test weight affects the production yield and therefore the flour yield. Higher test weight means higher flour yield.

If we look at only the 76 and 78 test weight quality difference between Ukrainian and Russian can say the price difference should be 4-6 USD. However, all other parameters need to conform with milling wheat requirements. If we see quality changes over all parameters, the price difference can increase up to 20-30 USD.

EXPORT TO EGYPT DOUBLED, BUT QUALITY FLUCTUATING

Export of Ukrainian wheat to Egypt doubled to 608 KMT in Jul-Dec 2023/24 MY, up from 301 KMT over the same period in the previous season. Competition from Russia here remains also strong, with deliveries of Russian origin amounted to almost 3 MMT in Jul-Dec 2023/24 MY, down from 3.55 MT a year ago.

Mina Beshay,

General Manager of Import Operations Horus Trade, Egypt:

The quality of Ukrainian wheat in 2023 was not constant. It was fluctuating with huge range especially the gluten and falling number. Sometimes the falling number was 180, then the next shipment was 200, another one is 220. The same goes for the gluten number; sometimes it is 19, another time it is 20. It was an issue about constancy.

The problem we faced with Rus wheat that we could not find quantities of high protein wheat like 14.5% and 15.3%. Regarding the test weight, we usually ask our suppliers to make the test weight minimum 77 in the contracts. We never accept goods with test weight 76 minimum.

LEBANON ADAPTING TO CHANGES IN QUALITY OF UKRAINIAN WHEAT

Approximately during the last two seasons, Lebanon imports wheat within tenders, funding by the World Bank, and the country has adjusted its quality requirements to make them more suitable for Ukrainian origin. Thus, the supply of Ukrainian wheat to this market remained rather strong this season.

Shipment of Ukrainian wheat to Lebanon totaled 217 KMT in Jul-Dec 2023/24 MY, down slightly from 261 KMT supplied over the same period of the preceding season. This decline is based on the fact that the sea export of Ukrainian wheat in the first months of the current season was virtually absent until the Ukrainian corridor was launched and gained momentum. Also, exporters were concentrated on selling corn rather than wheat. After the decrease in corn prices, we expect to see more offers of wheat that will stimulate wheat shipments in the second half of the season, including sales to Lebanon.

Mahmoud Shabarek,

Director at Shabarek Trading, Managing Director of Baraka Mills:

We see significant challenges in the global wheat trade, especially concerning Ukrainian wheat. The variability in quality, with specific mentions of decreased protein content and lower test weight than in previous years, points to a complex agricultural and trading environment. This situation underscores the importance of quality standards in the grain trade, such as maintaining a minimum test weight of 76 kg/hl, which is crucial for flour extraction efficiency. The anticipation of 11.5% handy-size vessels for a Lebanese tender in February indicates ongoing trade activities and the logistical efforts to meet demand despite quality concerns. The dates for the upcoming World Bank program tender are still undisclosed by the Ministry of Economy; however, it is worth mentioning that more than 80% of the wheat was procured from Ukraine.

UKRAINIAN FEED WHEAT IN DEMAND ON SOME EU MARKETS

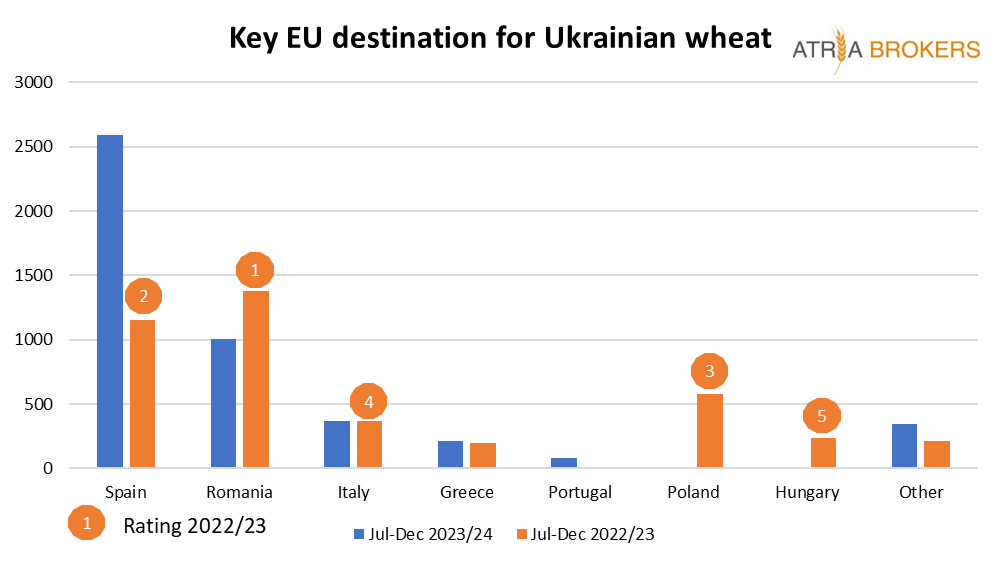

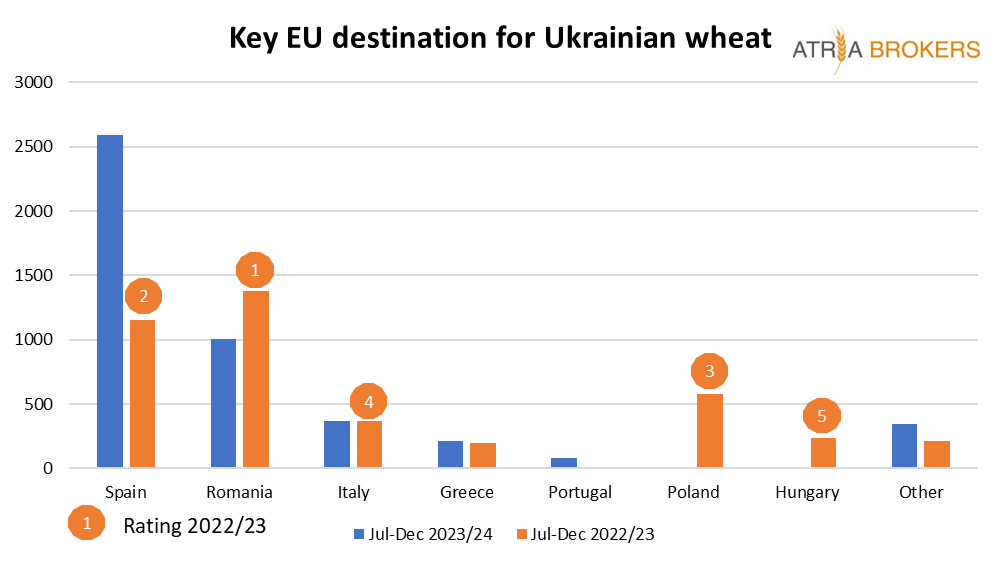

Ukrainian feed wheat finds good demand in Spain this season, as the country requires high imports after a drought-hit harvest. Ukraine exported 2.6 MMT of wheat to Spain in Jul-Dec 2023/24 MY vs 1.15 MMT over the same period a year earlier.

There is also stable demand from Italy, which bought 371 KMT of Ukrainian wheat so far in 2023/24 MY, with the volume steady y/y.